top of page

Distillates Signal Stress as FX Skews Biofuel Margins

Today’s session highlighted how energy, currency, and biofuel markets are sending conflicting signals, with basis and FX doing more work than flat prices. The U.S. winter storm again exposed the fragility of Northeast energy supply. Petroleum fired power generation overtook natural gas for roughly 36 to 48 hours as pipeline congestion limited gas deliverability. This occurred despite gas being nominally available. Natural gas pricing proved unreliable as an indicator. Henry

Henri Bardon

Jan 293 min read

European Biodiesel Capped by Feedstock Anomaly as Distillate Tightness and Paper Hedging Diverge

Middle distillates tightened into expiry while biofuels remained constrained by feedstock pricing and risk management behavior. February U.S. heating oil traded near 2.67 dollars per gallon while February ICE gasoil traded around 703 dollars per metric ton, implying a heating oil premium of roughly 100 dollars per metric ton after unit conversion. ICE gasoil spreads stayed backwardated, with Feb Mar near plus 10 dollars per metric ton and Feb Apr near plus 25 dollars per me

Henri Bardon

Jan 284 min read

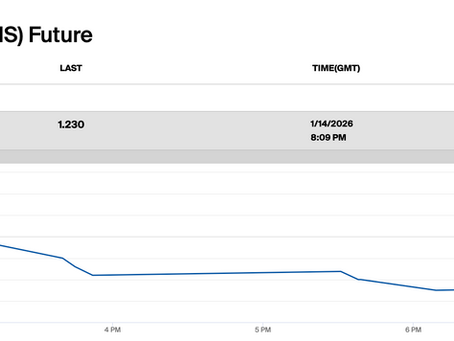

Biodiesel margins resurface as markets price war risk and weak $

Crude and products led again. WTI rose more than 3 percent to trade above $62 per barrel, while Brent gained over 3 percent into the $67 to $68 range. ICE low sulfur gasoil settled near $690 per metric ton. The curve tightened materially at the front. February–March backwardation stands near plus $10 per metric ton, while February–April is around plus $25. Roughly 40 percent of the front three month backwardation is concentrated in the first spread , a configuration normally

Henri Bardon

Jan 274 min read

Policy Optionality Dominates While Feedstocks Stay Abundant

Markets continue to price policy optionality while physical signals point to abundance. D4 RINs trade near 1.38 for December 2026. At that level, biodiesel economics improved sharply. The US biodiesel screen margin sits near minus 0.05 dollars per gallon before any 45Z value , versus margins near minus 0.40 dollars per gallon during late 2025. This shift explains why operating rates stabilized rather than falling further. Options flow shows tight event timing. March soybean o

Henri Bardon

Jan 263 min read

Flat prices refuse to crack

In ARAG, the window showed limited headline movement over the past week. RME flat price edged up from 1372 to 1375. The adjustment came through weaker premiums versus ICE gasoil, now near plus 697. HVO Class II moved lower, with flat price down from 2511 to 2462, driven by a premium compression of around 55 per metric ton. UCOME stayed broadly stable, with flat price easing from 1421 to 1405 and premiums adjusting lower by about 25 per metric ton, in line with RME. SAF price

Henri Bardon

Jan 233 min read

Clean Fuels Orlando, Strong Signals, Structural Frictions Remain

I spent the week in Orlando at the Clean Fuels Conference. Attendance was estimated at more than 1,500 participants across producers, airlines, jobbers, growers, policymakers, and service providers. Several long-time attendees said they had not seen this level of policy alignment since the early RFS expansion period around 2011. On the bullish side, three quantified themes dominated the discussion. First, proposed RFS volumes are moving higher. EPA plans to express the bioma

Henri Bardon

Jan 225 min read

Carry rebuilds in soyoil as biodiesel timing pulls production forward

Markets closed the week with structure doing more work than flat price. Early volatility gave way to selective positioning, with spreads, carry, and compliance instruments providing clearer signals than outright rallies. Across regions, price action reflects timing and regulatory optionality rather than physical scarcity. United States pricing continues to hinge on March RVO expectations. D4 RINs finished the week firm, with Dec 26 settling around 1.285. That level held despi

Henri Bardon

Jan 163 min read

Gasoil unwinds part of the risk premium while markets still price uncertainty

The shift started with a softer tone from the Trump administration on Iran. Fears of near term military action eased and energy reacted quickly. ICE gasoil slipped back toward 640, removing part of the geopolitical premium built over the past two weeks. Context matters. Gasoil traded as low as 558 on January 6, surged to around 660 by January 14 as rhetoric escalated, and has only partially retraced. Based on that move alone, more than 75 percent of the Iran related risk prem

Henri Bardon

Jan 153 min read

Policy and Legal Risk Drive Vegoils as Palm Demand Slips and UCOME Turns Bearish

Vegetable oil markets firmed on January 14 across soyoil, sunflower oil, and biofuel RINs credits. Price action reflects policy, compliance structure, legal risk, and geopolitics rather than tightening agricultural balances.

Henri Bardon

Jan 144 min read

Macro Risk Lifts Energy While Biodiesel Economics Drive the Narrative

Tuesday marked a clear turnaround in flat prices, driven by macro and policy risk rather than a change in feedstock fundamentals. ICE gasoil February settled near 654 dollars per ton, up roughly 27 dollars on the day, a gain of about 4.4 percent. CBOT soybean oil followed, with nearby contracts up around 1.1 cents per pound, close to plus 2.2 percent. Despite higher flat prices, Mar BOGO held near 485 to 490 dollars per ton. The lack of spread expansion confirms that the move

Henri Bardon

Jan 134 min read

Surplus Crops Meet Surplus Energy

The January USDA WASDE set a clearly bearish tone for oilseeds . World soybean ending stocks for 2025/26 are estimated near 123 to 124 million metric tons. Brazil’s soybean crop is marked around 178 million metric tons, which places global carryout near 70 percent of Brazilian production . US soybean ending stocks rose to about 350 million bushels versus trade expectations near 290. This balance sheet leaves little room for oilseed tightness and frames the vegetable oil compl

Henri Bardon

Jan 124 min read

Policy Gravity Holds the Line as Margins Diverge Across Regions

Energy markets moved into defensive mode ahead of the weekend, driven primarily by geopolitical risk management and position clean-up. ICE gasoil rallied into January expiry as participants reduced exposure before the weekend . The Jan/Apr backwardation moved nearly 30 percent higher on the day to around $9.50 per metric ton, while the Jan/Jul backwardation widened to roughly $20 per metric ton. This price action reflects pre-weekend covering and expiry dynamics rather than a

Henri Bardon

Jan 95 min read

Policy Support Carries EU Policy the While Fundamentals lag

Europe enters a decisive quarter for RED III because national transposition, not EU level ambition, determines real biofuel demand. RED III is a directive and does not apply automatically. Each member state must transpose it into domestic law. The legal deadline for transposition was 21 May 2025 . Several large member states missed this deadline and still operate under legacy RED II based frameworks. Missing the deadline does not suspend RED III obligations. It increases unce

Henri Bardon

Jan 84 min read

Energy Leads Lower While Policy Biodiesel/RD/SAF Urgency Fades

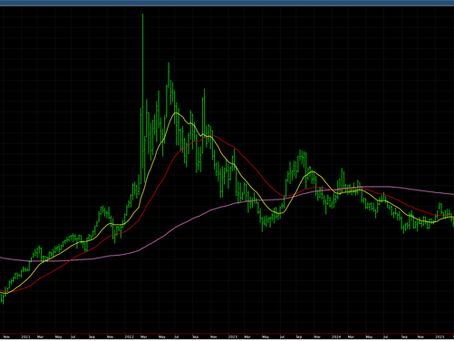

Energy markets continue to lead the complex lower. ICE gasoil front month trades near 599 dollars per metric ton , and the weekly chart now clearly points to the next technical support around 565 . The Jan–Apr backwardation has compressed to roughly +7.75 dollars per ton , down from around +50 in November , confirming a structural softening rather than a transient move. Gasoil chart just looks terrible.

Henri Bardon

Jan 73 min read

US Biofuels Remain Constrained As Feedstock Usage Falls And Economics Stay Negative

The theme today is the United States, even though Europe and global vegetable oils continue to shape pricing signals. The US feedstock usage data from October, while backward looking, remains the best structural reference for how early 2026 is unfolding. When combined with current margin screens and energy structure, it paints a difficult picture for advancing the sector .

Henri Bardon

Jan 63 min read

Geopolitics Lifts Energy, Feedstocks Push Back

The year starts with geopolitics tightening rather than easing. USD RUB trades back above 80 and sits near 80.8 after dipping into the high 79s late last week. This level has historically aligned with rising geopolitical risk, not progress on Ukraine. Gold confirms the signal, trading near 4,453 per ounce, close to a one standard deviation move on the day. Energy markets are reacting accordingly. Heating oil futures are higher across the curve, with front months up around 2

Henri Bardon

Jan 54 min read

Year End Markets Close with Caution

Today being New Year’s Eve, I want to wish everyone a Happy New Year while still closing out the year with a proper market read. Liquidity was thin and participation light, but price signals across energy, feedstocks, policy, and biofuels remain consistent.

Henri Bardon

Dec 31, 20252 min read

Margins Still Exist in Europe, But Structure Is Breaking Everywhere Else

Flat price support has now broken across the core inputs that anchor biodiesel economics. Both ICE gasoil and CBOT soybean oil have confirmed downside trend damage , with the 20 day weighted moving average now at least $20 per metric ton below the 50 day weighted moving average in each market. This marks a clear shift in momentum after repeated failed recovery attempts and signals that the market is no longer stabilizing.

Henri Bardon

Dec 30, 20253 min read

Biodiesel Markets Reprice Risk as Energy Signals a Peace Premium Unwind: ICE gasoil structure and USD RUB imply a 60 to 65 percent probability of a Ukraine deal, shifting biodiesel flat price risk

Global biodiesel markets ended the session with energy structure sending the clearest signal of the day. Jan Apr ICE gasoil backwardation slipped again to 12.50, down roughly 9 percent on the day and now a fraction of early November levels. This move is not about refinery outages or seasonal tightness. It reflects geopolitics. Markets are pricing a Ukraine outcome with a meaningful chance of de escalation. Based on USD RUB trading near 78, FX markets imply a 60 to 65 percent

Henri Bardon

Dec 29, 20254 min read

Henri Bardon

Dec 24, 20250 min read

bottom of page