Biodiesel Bulls Beware: Feedstock Glut Looms

- Henri Bardon

- Aug 13, 2025

- 2 min read

Gasoil stayed soft, with Sep ICE NWE down $6.75/t to $653.25 and weakness across the curve. That slippage pushed BOGO to +$525/t, widening the gap between fossil and soft oils. The latest WASDE was broadly bearish for vegoils, underscoring the likelihood of a large global oilseeds crop ahead. While U.S. soybean ending stocks for 2025/26 were cut to 290m bu, soyoil carry-in and ending stocks rose by 50m lbs, and ample global oilseed supply projections weighed on sentiment. Soymeal rallied sharply, but soyoil’s bounce faded on softer crude and active product spreading.

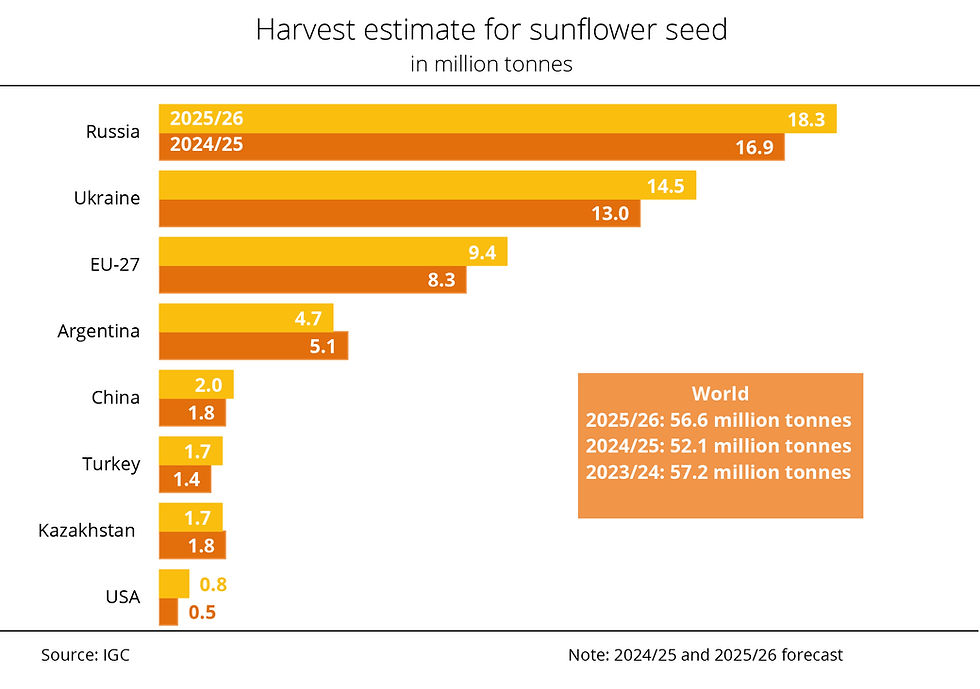

Veg-oils were mixed. Malaysian CPO flirted with four-month highs near 4,400 ringgit/t before profit-taking; Chinese palm olein remained supportive, and Indonesia’s eventual B50 keeps sentiment firm. In Europe, rapeseed oil bent lower as Canada eyes the EU after China’s provisional 75.8% anti-dumping deposit on canola effectively chokes that route. EU rapeseed imports could swell as these Canadian volumes are redirected, adding to the pressure from a bigger sunflower seed balance and helping frame a much heavier feedstock outlook. Sunflower oil still looks too punchy relative to supply: the EU-27 crop is seen up ~14% y/y to ~9.4 Mt and Ukraine up ~11% to ~14.5 Mt, tilting 2025/26 toward heavier seed availability even as some near-term flows wobble.

ARAG physical barges eased in outright terms but still carry chunky premiums: FAME 0 assessed at +688.17/t over ICE gasoil with a flat price of $1,336.80/t; RME at +690.17/t for $1,344.38/t; UCOME at +795/t for $1,449.96/t. On a gross margin read, RME stands out at ~$228/t (benefiting from softer RSO), UCOME around ~$301/t, and FAME 0 near ~$117/t. With feedstocks loosening—rapeseed pressured by displaced Canadian flows, bigger sunflower seed balances, and a broadly bearish oilseeds outlook from WASDE—these flat prices look vulnerable without a gasoil rebound.

Paper tracked softer in crops: Sep RME $1,337/t (+683.75/t, -14), FAME 0 $1,282/t (+628.75/t, -4), UCOME $1,447/t (+794.75/t, +1). The structure is telling: the prompt RME/FAME 0 spread sits around +4/t while 4Q trades near +91/t, signaling forward tightness in specs versus a heavy spot backdrop. HVO Class II Sep marked $2,177/t (+1,523.75/t) with light flow down the strip.

Policy noise remains loud. In the UK, producers under the Renewable Transport Fuel scheme are urging ministers to act quickly to prevent plant curtailments/closures. In the U.S., fuel retailers and biodiesel groups are backing efforts to get the RFS back on track, while SAF stakeholders press the EPA for stronger volume signals. Washington’s stance on the IMO’s net-zero plan—hinting at retaliation against members backing it—adds friction to shipping decarbonization debates, a headline risk more for sentiment and marine biofuel optics than for immediate biodiesel flows.

I will be away on a 10-day vacation and will return with the next market update after that.

Comments