top of page

Sanctions Supercharge Heat Cracks supporting Biodiesel — China Poised to Unleash Diesel Export Tsunami

Global diesel markets exploded higher to start the week, with ICE gasoil rallying nearly 5% as cash differentials hit three-year highs amid firm trading sentiment and a tightening European supply backdrop. Heating oil cracks have now surged to almost $50/bbl , while WTI sits at just $57.82/bbl , a spread that effectively values distillate yields at the equivalent of $100/bbl crude . The cause is clear — the latest U.S. and EU sanctions on Russian diesel exports have choked o

Henri Bardon

Nov 11, 20253 min read

Top Strategies Shaping Biofuel Markets

The biofuel industry is evolving rapidly, driven by technological advances, shifting regulations, and growing environmental concerns. Navigating this complex landscape requires a clear understanding of the strategies that are shaping the biofuel market strategies today. From feedstock innovation to policy adaptation, these approaches are critical for businesses aiming to thrive in the renewable energy sector. Embracing Feedstock Diversification for Resilience One of the most

Henri Bardon

Nov 11, 20253 min read

The Bean Oil-Palm Oil Blowout: Trading the Great Decoupling

For global biodiesel and renewable diesel traders, today’s market is a tale of divergent realities rather than a uniform trend. We are witnessing a complex decoupling where tightening soy dynamics collide with bearish palm data , and where severe logistical nightmares in the US contrast sharply with deceptive stability in Europe. Operational hostility currently defines the North American landscape. We are facing active bottlenecks on the Mississippi River, where gauges near S

Henri Bardon

Nov 10, 20253 min read

EPA Exemptions Hammer RINs as U.S. Shutdown Deal Brings Only Temporary Relief

The EPA’s Friday ruling on 16 Small Refinery Exemption petitions sent another shock through the RIN complex, exposing how fragile confidence has become in U.S. biofuel policy. The agency granted two full exemptions and twelve partial (50%) waivers across compliance years 2021–2024, totaling roughly 740 million RINs . Analysts were quick to flag discrepancies in the agency’s math— 150 + 70 + 250 + 260 ≠ 740 —raising questions over transparency and data handling. Even allowi

Henri Bardon

Nov 9, 20252 min read

Advanced FAME Emerges as Asia Prepares for B50

European biodiesel markets ended Thursday steady, but with deeper structural change underway. In the ARAG barge window, RME $1,425/mt , FAME 0 $1,322/mt , and UCOME $1,493/mt left RME gross margins around $145/mt versus rapeseed oil €1,115/mt (× 1.1545) . The ICE gasoil Nov/Apr spread held firm above +$73/mt , confirming tight prompt diesel supply amid sanctions and refinery constraints in Northwest Europe. The market is also watching an emerging divergence within renewabl

Henri Bardon

Nov 6, 20253 min read

Tight Gasoil, Tighter Biofuel Uncertainty

Europe’s biodiesel market remained subdued mid-week even as energy futures surged. The ICE gasoil Nov/Apr backwardation widened to +77.75 $/mt , its steepest in months and more than 20 percent higher than at the start of the week, underscoring acute prompt tightness ahead of the November delivery window. Physical ARAG barge trading stayed thin, with RME +$698/mt , FAME0 +$601.50/mt , and UCOME +$781/mt , while UCOME paper volume surpassed 200 kt early in the week—the heavies

Henri Bardon

Nov 5, 20253 min read

Heating Oil Rally Lifts Sentiment, but Biofuel Markets Stay Cautious

The first week of November opened quietly, with physical trading in ARAG still muted. RME settled at +$724.96/mt , FAME 0 at +$616.50/mt , and UCOME at +$801.67/mt , leaving spreads at RME/FAME +$108 and UCOME/FAME +$185 . HVO Class II $1,356.50/mt tracked firmer ICE gasoil $724/mt , keeping margins stable but narrow. Despite talk of softening cracks, gasoil Nov/Apr backwardation remains steep at +$63.50/mt , signaling ongoing tightness in prompt distillate supply. The stru

Henri Bardon

Nov 3, 20253 min read

Markets End October in a Fog

The month closed quietly in the physical market, with almost no barge activity in the ARAG window. RME settled at +719 over ICE gasoil , while all other grades finished below their monthly averages. The stillness in the barge trade contrasted sharply with the paper market, where both FAME and UCOME contracts saw heavy end-of-month positioning. Week 44 volumes in Northwest Europe jumped more than 200% from last week, a clear sign of fund unwinding before November roll dates a

Henri Bardon

Oct 31, 20252 min read

BOGO drops on tempered soy optimism as gasoil remains the weak leg of the biodiesel trade despite backwardation

Soybean oil futures ended lower Thursday, with Dec CBOT bean oil down 1% to $1,094.6/mt , while ICE gasoil edged up $2.75 to $721.25/mt , tightening the Nov/Dec backwardation to +$19.50/mt and Nov/Apr to +$67.25/mt —both higher on the day by 8.3% and 5.1%. Yet despite this apparent firmness in the forward curve, gasoil remains the weak structural leg of the biodiesel trade. The price strength is almost entirely curve-driven, not demand-led. Industrial diesel offtake remains

Henri Bardon

Oct 30, 20253 min read

Energy Strength vs. Trade Uncertainty – Biofuels Brace for Diplomatic Risk

After yesterday’s diesel-led distortion, today belonged to refining margins as heat cracks blew through $40/bbl , marking a multi-month high and reinforcing the disconnect between screen profitability and physical diesel demand. The same divergence was evident in Asia, where regional diesel margins breached $26/bbl even as cash premiums softened—a clear sign that refinery cracks are running ahead of consumption. ICE gasoil for Z25 held near $700.75/mt , the curve still backw

Henri Bardon

Oct 29, 20252 min read

Europe Politicizes Biofuels, U.S. Suffocates Under Logistics

Strange tape today as Europe once again traded against fundamentals. ICE gasoil slid to around $709/mt in a nearly one standard deviation move lower despite escalating sanctions rhetoric and tightening language from Brussels. The forward curve remains backwardated but visibly softer, with Nov/Dec narrowing 15% to +$16.75 and Nov/Apr at +$60.25. Cracks should be stronger at this stage of Q4 if supply risk were real, but screens continue to price pessimism rather than shortage.

Henri Bardon

Oct 28, 20254 min read

Sanctions Shock Lifts Gasoil; Palm Oil Faces Indonesia’s Military Grip

The market was jolted today as ICE gasoil futures surged sharply, climbing more than 6% in one of the largest single-day moves this quarter. The rally followed coordinated sanction announcements from both the European Union and the United States that expanded the list of Russian entities under SDN restrictions, including Rosneft and Lukoil. These measures go far beyond the partial restrictions introduced in 2022 . The earlier sanctions relied mainly on sectoral limits, price

Henri Bardon

Oct 23, 20253 min read

Starting Nov 1, I will be moving all my posts to Substack where you can subscribe

https://globalbiodiesel.substack.com/p/diesel-rally-collides-with-structural?r=3f53s9

Henri Bardon

Oct 22, 20251 min read

Diesel Rally Collides With Structural SAF Shift – China Takes More EU Market Share

ICE gasoil roared back with a one-day surge of more than 4 percent, easily clearing a one standard deviation move and reversing two weeks of weakness in a single session as EU clears a 19th Russian Sanctions package . The diesel-led rally tightened forward spreads, firmed refining cracks, and triggered mechanical compression across biodiesel and renewable diesel economics. The tone shift was aggressive , but it was entirely energy-led, not driven by any recovery in feedstock

Henri Bardon

Oct 22, 20253 min read

Emerging Trends in the Biofuel Market

The biofuel industry is evolving rapidly, driven by technological innovation, shifting regulations, and growing environmental concerns. As someone deeply involved in this sector, I’ve witnessed firsthand how these changes are reshaping the landscape. Understanding emerging biofuel market trends is crucial for businesses aiming to stay competitive and capitalize on new opportunities. In this post, I’ll break down the most significant developments, backed by practical insights

Henri Bardon

Oct 21, 20254 min read

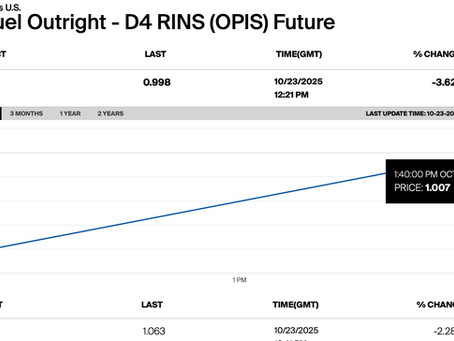

Biodiesel Credit Backdrop Weakens—BOPO Collapses as D4 RINs Slide

In the U.S., soybean oil finally broke lower with BOPO dropping nearly 25% to +44 $/mt, down almost 80% over the last three months. This marks the long-anticipated correction as harvest pressure collides with export bottlenecks. Roughly 90,000 soybean-oil call options expire within the next 31 days, most between 53 ¢/lb and 63 ¢/lb strikes, now largely out of the money. With no USDA harvest report due to the shutdown, private estimates suggest soybean harvest is already near

Henri Bardon

Oct 21, 20253 min read

Another Round of Mixed Signals and Weakening Freight as China Trade Fight Resumes

Trump’s latest comments attacking the IMO’s global carbon-tax proposal for shipping added another layer of confusion to an already unsettled market. He called it a “Global Green New Scam Tax on Shipping,” even as his own administration’s Section 301 tariffs continue to raise costs for shipowners and operators by extending duties to shipping-related goods and services. With the China trade war heating up again, the Baltic Clean Tanker Index dropped about 5 percent as charterer

Henri Bardon

Oct 16, 20252 min read

Fujairah Stocks Surge 9% as Gasoil Slips — Policy Volatility Lifts RINs and POGO

Distillate fundamentals weakened sharply mid-week as ICE gasoil fell again to $636/t, and the Fujairah Energy Data Committee reported a 9% surge in total oil-product stocks to 17.81 million bbl, led by a substantial build in middle distillates. The increase reflects continued gasoil weakness and subdued regional demand , with storage hubs now absorbing excess cargoes as cracks soften. The front-month heat crack remains near $32.9/bbl —well below summer highs—highlighting som

Henri Bardon

Oct 15, 20253 min read

ICE Gasoil Breaks Lower as Biodiesel Spreads Flare

A sharp 2.5% drop in ICE gasoil today pushed BOGO nearly a full standard deviation higher to +481, underscoring renewed strain on biodiesel economics. The sell-off comes as oil majors and trading houses attempt to manage a temporary surplus of crude while refining margins remain historically high. According to executives from Vitol, Trafigura, and Gunvor, the current oversupply could persist into early 2026 before natural decline rates tighten the market again—leaving traders

Henri Bardon

Oct 14, 20252 min read

China Retaliation Deepens Trade Rift as Biodiesel Premiums Slip

Happy Columbus Day, everyone! While Washington appears to signal a thaw in U.S.–China trade rhetoric, Beijing’s retaliatory move under USTR Section 301 will take effect tomorrow and could ripple far beyond container freight. China’s new port fees—starting at $56/t and rising to $157/t by 2028—will apply to any vessel with 25 percent or more U.S. ownership, directly targeting fleets of U.S.-listed owners such as ZIM and Matson. Analysts warn this “wide-net” rule could ensnare

Henri Bardon

Oct 13, 20253 min read

bottom of page