The Sudden Demand Crash: Gasoil Falls, DXY on the Edge, Cracks Collapse

- Henri Bardon

- Aug 5

- 2 min read

Gasoil prices broke down decisively again today, with the prompt ICE contract settling at $667/mt — now well below key technical levels. The rejection at the 200-week moving average near $773 has turned the weekly chart bearish, reinforcing the impression that traders are preparing for a macro demand shock. Sep/Oct and Sep/Dec spreads continue to flatten, and the price action suggests more than just seasonal softness — it reflects real anxiety about future throughput.

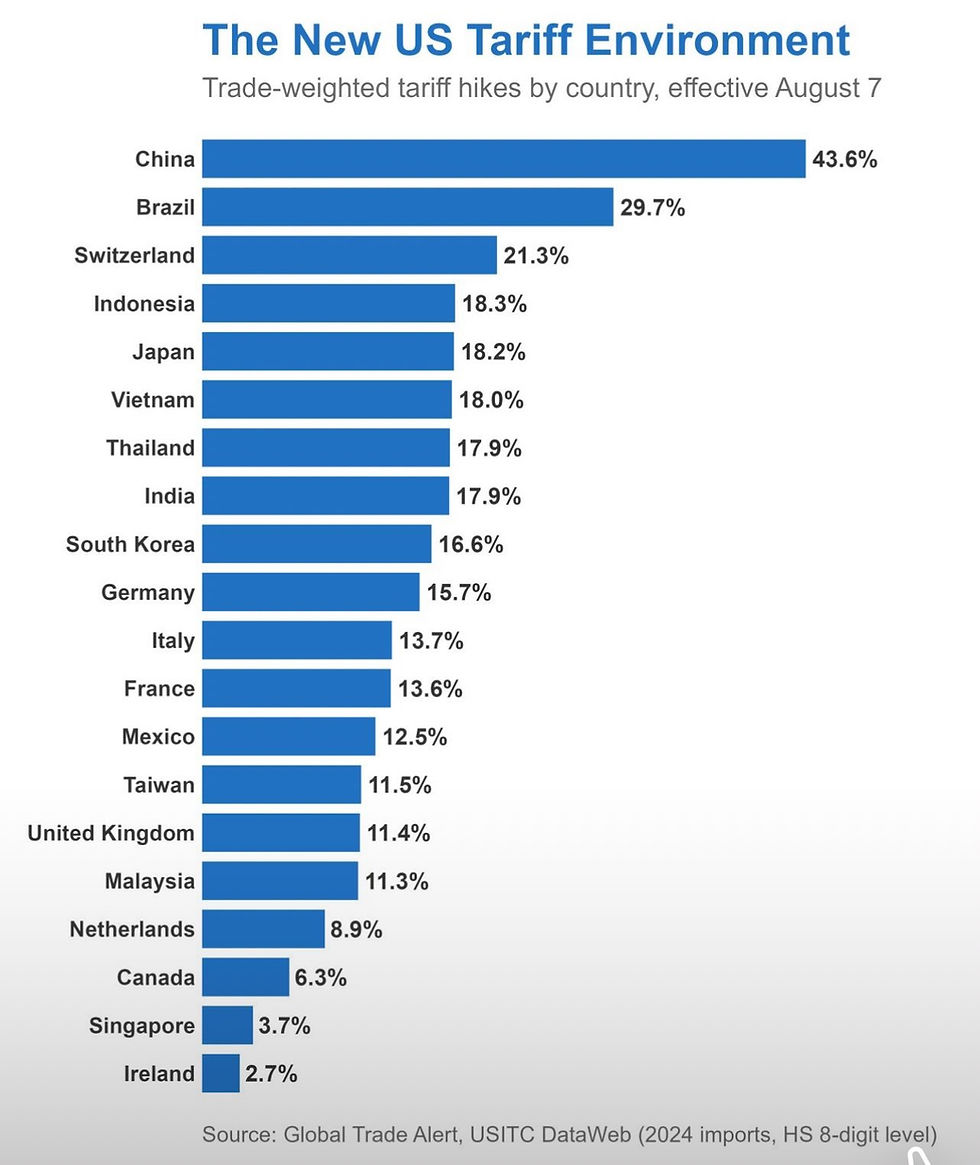

That anxiety is being amplified by the U.S. tariff package set to take effect on August 7. With sweeping hikes targeting China (+43.6%), Brazil (+29.7%), and several European and Asian partners, global trade flows are bracing for impact. Commodities — especially ags and vegoils — are already adjusting. China buying soymeal while selling soyoil to India is a perfect example of trade flows being reinvented to adapt. The ripple effects are visible in crush margins, freight demand, and now refined product markets.

In parallel, the screen heat crack spread — a key barometer of refinery profitability — has started to roll over. After holding strong for weeks, cracks are now falling despite the summer diesel demand window. This could reflect the market pricing in refinery run cuts ahead of fall, or worse, fading end-user demand due to a global industrial slowdown. Refiners, who typically lead the demand curve, appear to be moving into a defensive posture.

The U.S. Dollar Index (DXY) is now testing its 200-week moving average — and this may be the most important chart of the day. A break of this long-term support would not just be a technical failure, but a signal that a broader macro regime shift is underway. A structurally weaker dollar would reprice commodities upward, alter capital flows, and undermine the dollar’s perceived safety. It would also challenge the post-COVID investment cycle, forcing new alignment across emerging markets, central banks, and risk assets.

Markets are clearly under pressure across multiple axes — energy, trade, currency, and refining margins. Yet biofuels remain relatively firm for now, with UCOME holding above $1,450/mt and the UCOME/FAME spread widening to 105. HVO and SAF premiums are rising on tightening supply and robust discretionary interest. But make no mistake: if the dollar breaks down and demand falters further, even resilient sectors like biodiesel will face a recalibration. The warning signs are surely lining up.

Comments