Palm Oil’s Shadow: Global Feedstocks Under Pressure

- Henri Bardon

- Jun 11, 2025

- 2 min read

European biodiesel and renewable diesel markets continue to show solid margins despite persistent cost pressures. In ARA barge trading, FAME 0 remains steady at $1,346/mt with a $132/mt margin, and RME is trading close by with a $133/mt margin. UCOME leads the pack with a strong $248/mt margin, supported by flat prices around $1,423/mt. Meanwhile, the SAF-HVO CL2 premium is widening again, with SAF quoted at $1,957/mt versus HVO CL2 at $2,029/mt—a divergence that may be tested further by European co-processing trends and opaque HEFA-SPK market conventions as each producer has slightly different densities.

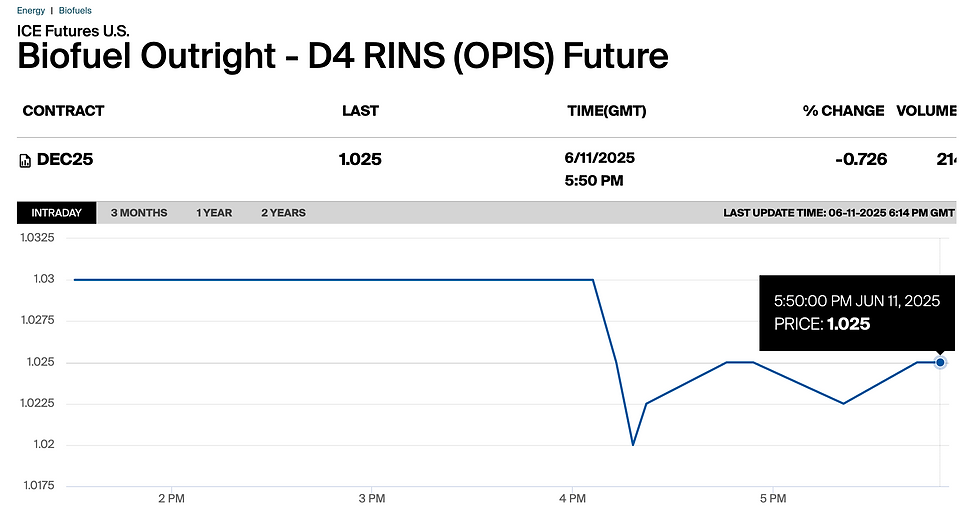

Across the Atlantic, U.S. biofuels producers remain in wait-and-see mode regarding federal policy. D4 RINs edged up slightly to $1.025, but the biodiesel margin remains negative at -$0.36/gal. Without clear guidance on the Blender’s Credit or 45Z, producers are increasingly reliant on state-level programs such as California’s LCFS and various Midwest mandates to stay afloat. Notably, U.S. feedstock dynamics remain challenging, with soybean oil softening slightly amid uncertainty over RVO targets and upcoming weather impacts on the U.S. soybean crop.

In Asia, feedstock markets are being reshaped by renewed palm oil demand. India and China have returned aggressively to the palm oil market following a 12% price correction. Indian buyers are actively booking volumes for June through August, while Chinese imports are surging due to low domestic stocks. Malaysian palm olein offers around RM 3,900–4,200/mt (~$884–950/mt) are currently undercutting soybean oil, spurring increased trade flows. While palm oil is prohibited as a feedstock for RED-compliant biodiesel and renewable diesel in Europe & US (with the exception of POME under Annex IX for EU), shifts in palm demand significantly influence the global vegetable oil balance, affecting the availability and pricing of soybean and rapeseed oils used in European & US biofuels production.

One additional factor to monitor is the ongoing low water situation on the Rhine River, which remains below normal despite recent rains. Navigation remains restricted, with ships operating at only 50–80% capacity and Kaub continuing to pose a chokepoint. Freight costs have surged—tripling since March—and the outlook remains concerning as drought conditions persist. With the European rapeseed harvest approaching, the Rhine bottleneck could disrupt inland movement of rapeseed oil and advanced biodiesel feedstocks, adding logistical risks to an already tight feedstock market.

Looking ahead, traders should keep a close watch on three key dynamics: the durability of the SAF/HVO premium in Europe, the potential for further tightening in global vegetable oil markets, and any shifts in U.S. federal biofuels policy—particularly regarding RVO and 45Z implementation. With margins somewhat attractive in Europe (high EU transformation costs will remain an issue) but feedstock and logistics risks looming, and with Asian trade flows accelerating, this summer promises continued volatility across global biofuels markets.

Comments