Global Diesel Supply Crunch Lifts Biodiesel Premiums Ahead of Tuesday EPA Public Hearing

- Henri Bardon

- Jul 7

- 2 min read

A global diesel supply crunch is dominating energy markets this week, pushing prompt-month Gasoil spreads into record backwardation. The Jul/Sep Gasoil spread reached +$71/mt, a level not seen in years, while prompt ULSD barges in the ARA hub surged to a +$44/mt premium. These price signals reflect an urgent shortage in physical supply, not just in the U.S. but across Europe and globally. In Northwest Europe, refinery outages, permanent closures, and limited diesel-rich crude inputs have contributed to the lowest diesel share of refined product output—just 31.4% in June—underscoring how precarious the supply situation has become.

Europe’s diesel tightness is structurally driven and independent of U.S. regulatory debates. Key supply disruptions stem from OPEC+ production cuts and the shift toward lighter Kazakh crude exports, which yield significantly less diesel. This has been compounded by geopolitical constraints, heatwaves curbing refinery throughput, and limited near-term relief from Canadian exports. As a result, ARAG diesel barge premiums remain elevated, forcing traders to secure supply at any cost. These conditions are beginning to filter into the biodiesel market, where similar supply-and-demand pressures are lifting premiums across the board.

In biodiesel, market structure remains firm. The RME/FAME 0 spread stood at +$3.50/mt, while UCOME continues to command a massive +$112.50/mt premium to FAME 0. These strong premiums come even as the BOGO spread (Soyoil minus Gasoil) has fallen nearly $40/mt in just a week, now around $441.78. The divergence illustrates a key decoupling—physical margins in Europe remain well supported by tight diesel fundamentals, while paper crush indicators have softened. Traders are clearly focused on actual molecule scarcity rather than paper spreads.

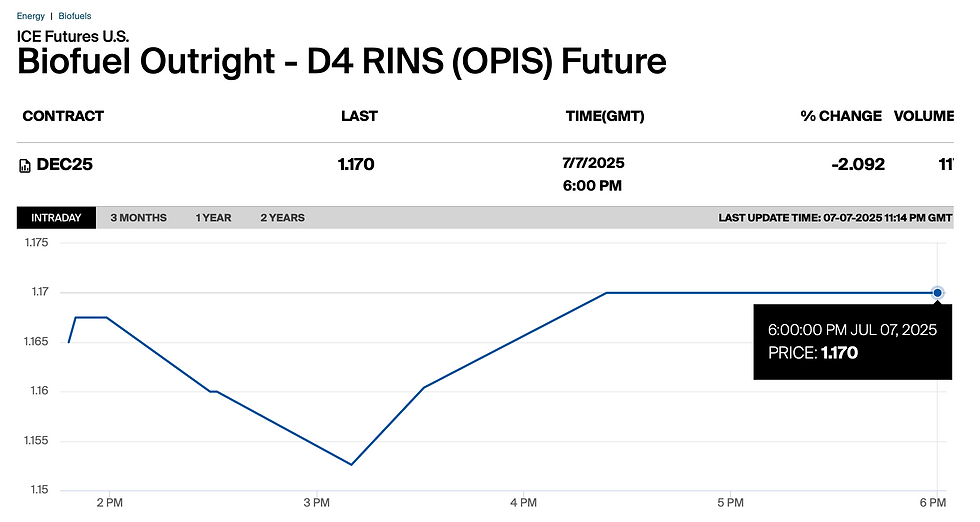

In the U.S., the focus is on the EPA public hearing scheduled for Tuesday, July 8, with a potential extension into Wednesday, July 9, covering proposed 2026–27 RVOs and a contentious rule to limit RIN generation from foreign feedstock. While D4 RINs have barely moved—stuck at 1.17—the weekend was full of congratulatory messages from clean fuel advocates and fuel retailers following the passage of the updated Budget Reconciliation Bill (BBB). The improvements to Section 45Z are particularly meaningful, providing enhanced visibility and incentive certainty for renewable diesel and SAF projects starting in 2025. Still, the market remains wary—without clarity on Small Refinery Exemptions (SREs), pricing remains capped despite favorable policy momentum.

Geopolitical trade tensions add to the complexity. President Trump on Monday lashed out at Japan and South Korea for not proactively negotiating bilateral trade deals, while threatening tariffs on BRICS-aligned nations. Most striking for the biodiesel market is the continued silence around U.S.-EU negotiations, leaving the fate of transatlantic flows of renewable diesel, biodiesel, and key feedstocks in limbo. With the EPA hearing, tightening diesel supply, firm ARAG premiums, and shifting trade alliances all in play, biodiesel traders face one of the most geopolitically and structurally charged weeks of the year.

Comments