BOGO Breakout Defies Gasoil Fundamentals

- Henri Bardon

- Jun 27

- 2 min read

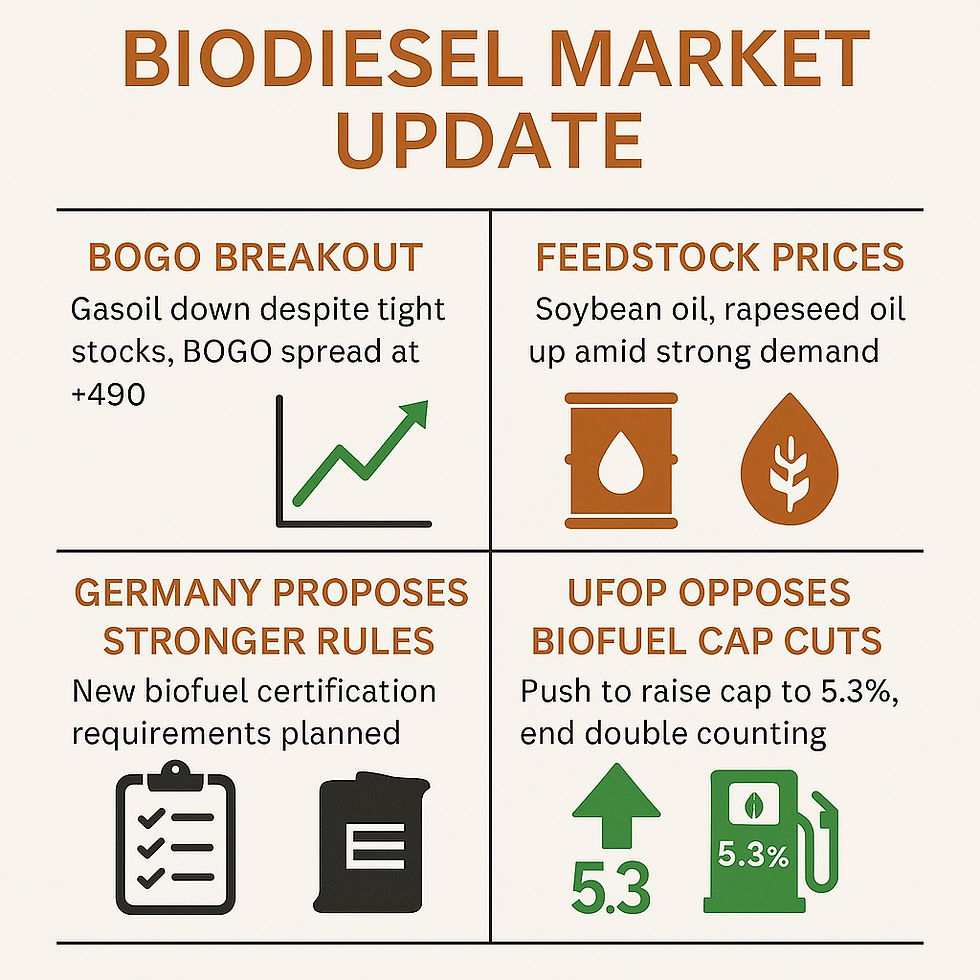

Despite signs of a global supply crunch in middle distillates, ICE gasoil futures continue to underperform, pushing the BOGO spread to +490. In the past week, gasoil inventories in the ARA hub dropped by 10%, while Singapore's middle distillate stocks fell 8%, equivalent to a 900,000-barrel draw. These sharp weekly reductions point to increasing tightness in the physical market. Yet the futures curve remains sluggish, leading to an unusual divergence that is boosting biodiesel margins and drawing speculative attention.

In today's ARAG window, FAME 0 traded at $1394/mt, while RME was stable at $1445/mt. The RME/F0 spread narrowed to $51/mt. UCOME also held firm at $1459/mt, maintaining a $65/mt premium over FAME 0. Despite limited volumes, gross margins remain attractive across the board, and Q3 interest is growing. D4 RINs softened slightly to 1.140, as the U.S. market remains caught in regulatory uncertainty.

Feedstock prices were surprisingly well-supported despite the weakness in gasoil. Soybean oil and rapeseed oil both posted modest gains, with Dutch-origin soybean oil for July rising to Eur1135/t and rapeseed oil moving up to Eur1095/t. Sunflower oil remained stable at Eur1200/t. Adding to potential volatility, Donald Trump announced that all trade discussions with Canada are being terminated due to disputes over dairy tariffs and a new Canadian digital tax. With new tariffs promised within seven days, markets are watching closely for any impact on North American agri-flows, particularly Canola oil, soybean oil and meal - Ag Trade with Canada is significant at $30-40Bil annually.

Policy developments in Europe are accelerating. Germany is preparing a stricter biofuel certification regime, with tighter controls on registration, physical audits, and import eligibility. Belgium also released its draft RED III framework this week, continuing a broader trend of regulatory tightening across the bloc. These developments are expected to reshape sourcing strategies for advanced biofuels and place additional scrutiny on imports, especially those seeking double-counting benefits.

At the same time, UFOP is pushing back hard against proposals to reduce the crop-based biofuel cap. The organization is calling for an increase to 5.3%, citing the importance of biodiesel demand for domestic rapeseed meal production. UFOP has also reiterated its call to eliminate double counting altogether, arguing that it undermines market integrity and disadvantages certified producers. With protein meal exports already in decline, the stakes are rising for both fuel and feed markets in the months ahead.

Comments